T-Mobile announced in a Form 8-K last month that it had suffered a cybersecurity breach that could present “significant,” yet probably not material, costs to the company. The disclosure included a swath of information — including details on the types of files accessed by bad actors, where hackers probably got into T-Mobile’s systems and a… Continue reading Though ‘Inconsistent,’ Cyber Breach Disclosures Pack in a Range of Details

Tag: 8-K

What Sets Some Companies Apart in the Current Crisis

As the downturn has affected a growing number of companies, it has become plain that “no one is immune” from letting workers go, in the words of Richard Florida, who teaches economic policy at the University of Toronto.

Yet as our most recent research shows, some companies are better inoculated than others from having to furlough or lay off people—namely, those that are most effectively managed.

Our findings are based on a statistical model that was created by the Drucker Institute and underlies the Management Top 250, an annual ranking produced in partnership with The Wall Street Journal. Rooted in the core principles of the late management scholar Peter Drucker, it assesses a company’s “effectiveness”—defined by Mr. Drucker as “doing the right things well.” The 2019 list was published in November.

In all, we examined 820 large, publicly traded companies last year through the lens of 34 indicators across five categories: customer satisfaction, employee engagement and development, innovation, social responsibility and financial strength.

SEC Tracking Covid-19 Disclosures on Human Capital

Boards should expect pressure from investors and regulators to disclose more information on workforce health and safety measures in light of the Covid-19 pandemic, experts say.

Major investors say the current disclosures aren’t detailed enough, and a large group is pressuring the SEC to ramp up disclosure requirements on the effectiveness of companies’ human capital–related measures. The commission appears to be hearing some of those demands as SEC officials say disclosures related to human capital are being integrated into rulemaking.

This comes on the heels of an SEC roundtable with prominent investors, who called for more transparency on remote working costs, protective equipment for employees and specific forward-looking guidance on liquidity plans.

Companies Choose Furloughs Over Layoffs to Manage Coronavirus Slowdown

When meat orders from restaurants, hotels and other food-service clients dried up at two of Hormel Foods Corp.’s plants in April, finance chief Jim Sheehan chose to furlough roughly 350 workers, but didn’t lay them off. These furloughed employees didn’t receive pay but got benefits such as health care.

It was a careful calculus. After years of effort to secure talent in a tight labor market, many finance chiefs responding to the shock of the coronavirus pandemic have so far preferred to furlough workers instead of severing ties completely, even if it means spending a little more.

“Our employees are long-term investments for us and they’re a precious resource, so we needed to do what we could,” Mr. Sheehan said.

Other finance chiefs made a similar choice as the coronavirus pandemic shut down businesses across the country. Of the 87 firms in the S&P 500 to announce staff reductions from early March through the end of June, 65 chose to furlough workers, according to an analysis of securities filings by data provider MyLogIQ.

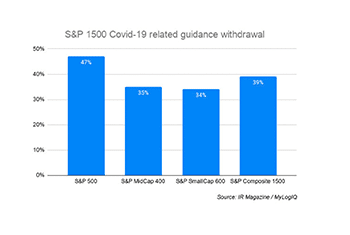

Covid-19: The Impact on Guidance, Buybacks and Dividends in the S&P 1500

Covid-19 has led to widespread changes to financial guidance, buyback programs and dividend payments across the whole of the US equity market, although notable differences exist between different market-cap segments, according to new research.

IR Magazine has worked with MyLogIQ, a provider of intelligence tools focused on compliance and disclosure, to understand how companies on the S&P Composite 1500 Index have responded to disruption caused by the pandemic.

To gather the data, MyLogIQ analyzed SEC filings of companies included in the S&P 1500, which accounts for around 90 percent of US market capitalization, between March 1 and June 12. The firm used its AI-based platform to search for concepts such as ‘withdrawing guidance’, ‘dividend suspension’ and ‘share-buyback pause’.

According to the analysis, 39 percent of S&P 1500 companies withdrew financial guidance during this period. Looking at the main market-cap segments of the S&P 1500, guidance was withdrawn by 47 percent of companies on the S&P 500, 35 percent of the S&P MidCap 400 Index and 34 percent of the S&P SmallCap 600 Index.

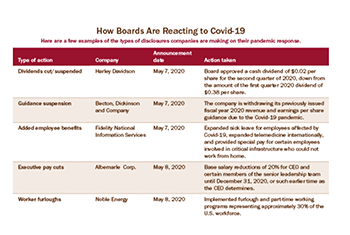

Pandemic Response by the Numbers

According to a review of SEC filings by S&P 500 companies by MyLogIQ, as of May 11:

- 273 S&P 500 companies have switched to virtual meetings

- 146 S&P 500 companies have suspended share buybacks

- 50 S&P 500 companies have suspended or cut dividends

- 37 S&P 500 companies have instituted job freezes

- 91 S&P 500 companies have cut executive compensation

- 60 S&P 500 companies have added paid sick leave or more employee benefits

- 231 S&P 500 companies have suspended guidance

- 72 S&P 500 companies have instituted worker furloughs or layoffs

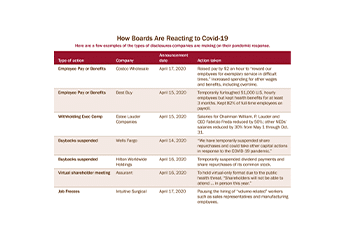

Here are a few examples of the types of disclosures companies are making on their pandemic response.

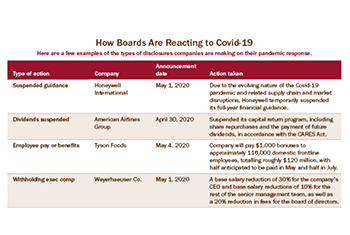

Pandemic Response by the Numbers

According to a review of SEC filings by S&P 500 companies by MyLogIQ, as of May 4:

- 264 S&P 500 companies have switched to virtual meetings

- 113 S&P 500 companies have suspended share buybacks

- 42 S&P 500 companies have suspended or cut dividends

- 28 S&P 500 companies have instituted job freezes

- 83 S&P 500 companies have cut executive compensation

- 50 S&P 500 companies have added paid sick leave or more employee benefits

- 200 S&P 500 companies have suspended guidance

- 57 S&P 500 companies have instituted worker furloughs or layoffs

Here are a few examples of the types of disclosures companies are making on their pandemic response

Pandemic Response by the Numbers

According to a review of SEC filings by S&P 500 companies by MyLogIQ, as of April 14:

- 65 S&P 500 companies have switched to virtual meetings

- 43 S&P 500 companies have suspended share buybacks

- 16 S&P 500 companies have suspended dividends

- 13 S&P 500 companies have instituted job freezes

- 47 S&P 500 companies have cut executive compensation (base salaries)

- 15 S&P 500 companies have added paid sick leave or more employee benefits

- 112 S&P 500 companies have suspended guidance

- 18 S&P 500 companies have instituted worker furloughs.